INDIA'S BEST STOCK MARKET COURSE - COMBO ( TECHNICAL ANALYSIS + OPTION TRADING )

Low investment courses with high return in knowledge

A Course for

Affordable

Now you can learn and earn from financial market without burning a hole in your pocket.

Easy Learning

Take your first step into financial market learning with our specially curated course modules.

Perfect Base Builder

Strong base-building modules to help a learner to build independently.

Jama Dhan - Combo Course

From Beginner to Advanced Traders 🌟

Jama Dhan – Technical Analysis Course” was created with the goal of releasing you from unaffordable losses, ignorance, and financial dependence.

Our Option trading course isn’t solely for experts; it warmly welcomes newcomers too. If you dream of boosting your monthly earnings, this is for you.

Combo Course (Technical Analysis + Option Trading)

₹50,000 Original price was: ₹50,000.₹25,000Current price is: ₹25,000.

₹50,000 Original price was: ₹50,000.₹25,000Current price is: ₹25,000.

How does this Course work?

Over the next months, you’ll dive deep into various trading concepts, develop practical skills, and gain confidence in your trading abilities.

Building a Strong Foundation

Introduction to Demand and Supply

- Overview: Understand the fundamental principles that drive market movements and price trends.

- Key Concepts: Supply and demand curves, equilibrium, and market dynamics.

- Practical Application: Analyzing real-world examples to identify trends and opportunities.

Pure Technical Analysis

- Technical Indicators: Learn about moving averages, RSI, MACD, and other technical indicators.

- Chart Patterns: Study common patterns such as head and shoulders, double tops, and triangles.

- Analysis Techniques: Practice drawing trend lines and identifying support and resistance levels.

Options Foundation

- Basics of Options Trading: Introduction to calls, puts, and the concept of options contracts.

- Why Trade Options: Advantages of options trading, including leverage and flexibility.

- Key Terms: Moneyness, intrinsic value, extrinsic value, and breakeven points.

Zones Analysis – Sector Correlation

- Sector Analysis: Explore the correlations between different market sectors.

- Identifying Opportunities: Learn to spot profitable trading opportunities within correlated sectors.

- Case Studies: Analyze historical data to understand sector performance during different market cycles.

Trading Plan (Position Size, Risk Profile)

- Developing a Trading Plan: Tailor a strategic plan based on your risk tolerance and financial goals.

- Position Sizing: Techniques for determining the appropriate size of each trade.

- Risk Management: Setting stop-loss levels and using risk-reward ratios.

Intermediate Technical and Options Analysis

In-depth Analysis of Charts

- Advanced Charting Techniques: Learn about candlestick patterns and their significance.

- Volume Analysis: Understand the importance of trading volume in confirming trends.

- Practical Application: Analyze charts and practice identifying key patterns and signals.

Options Buying vs. Options Selling

- Strategies Comparison: Compare the benefits and risks of buying versus selling options.

- Importance of Options Writing: Learn why writing options is crucial and the risks involved.

- Best Practices: Identify optimal times to buy or sell options for maximum profitability.

Gaps Analysis

- Understanding Gaps: Learn about different types of gaps (breakaway, runaway, exhaustion).

- Trading Gaps: Strategies for capitalizing on gaps in market price movements.

- Case Studies: Review historical examples of significant gaps and their outcomes.

Trading Psychology

- Psychological Aspects of Trading: Understand common psychological pitfalls and how to avoid them.

- Maintaining Discipline: Techniques for staying disciplined and sticking to your trading plan.

- Emotional Control: Strategies for managing stress and emotions during trading.

Options Selection Parameters

- Selecting Strike Prices: Criteria for choosing the right strike prices and expiries.

- Understanding Premiums: Factors that influence options premiums and how to evaluate them.

- Volatility Analysis: Impact of implied volatility on options prices.

Elements of Zones

Elements of Zones

- Trading Zones: Identify and understand the essential components of trading zones.

- Practical Application: Using zones to make accurate market predictions.

- Case Studies: Analyze successful trades that utilized zone strategies.

Greeks Analysis

- Introduction to Greeks: Learn about Delta, Theta, Vega, Gamma, and Rho.

- Managing Your Portfolio: Use Greeks to better manage and adjust your options portfolio.

- Practical Examples: Calculate Greeks for various options and understand their impact.

Multiple Time Frame Analysis

- Analyzing Different Time Frames: Learn to analyze multiple time frames for better decision-making.

- Combining Time Frames: Strategies for integrating short-term and long-term analysis.

- Case Studies: Examples of successful trades using multiple time frame analysis.

Curve and Trend Analysis

- Understanding Curves: Study yield curves and their significance in market analysis.

- Trend Analysis Techniques: Learn to identify and follow market trends effectively.

- Practical Application: Use curve and trend analysis to spot profitable opportunities.

Single Leg Strategies

- Basic Options Strategies: Implement strategies like Long Call, Long Put, Short Call, and Short Put.

- Risk and Reward: Evaluate the potential risks and rewards of each strategy.

- Case Studies: Examples of single leg strategies in action.

Refining Your Skills

Risk Correlations

- Risk and Options Trading: Understand the relationship between risk and options trading.

- Intrinsic and Time Value: Analyze how intrinsic and time value affect options pricing.

- Practical Examples: Evaluate risk correlations in different market conditions.

Gaps and Gaps Analysis

- Advanced Gaps Strategies: Further exploration of gap trading techniques.

- Risk Management for Gaps: Strategies to manage risk when trading gaps.

- Case Studies: Detailed analysis of trades involving significant gaps.

Odd Enhancers

- Unique Trading Factors: Discover unique factors that can enhance your trading decisions.

- Practical Application: Learn how to incorporate odd enhancers into your trading strategy.

- Case Studies: Examples of successful trades using odd enhancers.

Volatility Analysis

- Mastering Volatility: Understand the impact of implied volatility on options premiums.

- Volatility Strategies: Develop strategies to profit from changes in volatility.

- Practical Application: Use volatility analysis to make informed trading decisions.

Multi-leg Strategies

- Complex Options Strategies: Learn to build and execute multi-leg options strategies.

- Risk Management: Techniques for managing risk with multi-leg strategies.

- Case Studies: Examples of successful multi-leg options trades.

Advanced Techniques and Strategies

Entry and Exit Rules

- Developing Entry and Exit Strategies: Create effective strategies for maximizing profits.

- Timing Your Trades: Techniques for determining the best times to enter and exit trades.

- Practical Application: Practice developing and implementing entry and exit rules.

Trading Plan Refinement

- Optimizing Your Trading Plan: Refine your trading plan based on your experience and results.

- Risk Profile Adjustments: Adjust your risk profile as your confidence and knowledge grow.

- Case Studies: Review and analyze the trading plans of successful traders.

Anchor Unit and Offset Unit

- Using Anchor and Offset Units: Understand how to use anchor and offset units in your trading strategy.

- Practical Examples: Implement anchor and offset units in your options trading.

- Case Studies: Analyze trades that utilized anchor and offset units.

Advanced Technical Analysis

- Advanced Indicators: Learn about advanced technical indicators like Ichimoku Clouds and Bollinger Bands.

- Combining Indicators: Techniques for combining multiple indicators to confirm signals.

- Practical Application: Practice using advanced technical analysis to make trading decisions.

Trading Psychology Deep Dive

- Advanced Psychological Techniques: Explore deeper psychological aspects of trading.

- Building Resilience: Techniques for building mental resilience and maintaining focus.

- Practical Application: Apply psychological techniques to improve your trading discipline.

Mastering Market Movements and Strategies

Non-directional Strategies

- Market Volatility Strategies: Explore strategies that profit from market volatility without relying on direction.

- Open Interest Analysis: Understand the role of open interest in options trading.

- Practical Examples: Implement non-directional strategies in your trading.

Options for Rental Income

- Generating Income with Options: Discover how to generate consistent income through options trading.

- Rental Income Strategies: Learn strategies for using options to create a steady income stream.

- Case Studies: Examples of successful income-generating options trades.

Finalizing Your Trading Plan

- Comprehensive Trading Plan: Create a comprehensive trading plan that incorporates all the strategies and techniques learned.

- Review and Adjust: Continuously review and adjust your plan based on performance and market conditions.

- Case Studies: Analyze final trading plans of experienced traders.

Real-world Trading Simulations

- Simulated Trading: Practice real-world trading using simulated environments.

- Learning from Mistakes: Identify and learn from mistakes in a risk-free setting.

- Improving Strategies: Refine your strategies based on simulation results.

Graduation and Next Steps

- Review and Graduation: Summarize key learnings and celebrate your progress.

- Next Steps: Guidance on how to continue your trading journey and further improve your skills.

- Continued Education: Resources for continued learning and staying updated with market trends.

Perks Along with Course✨

Lifetime Mentorship Support

Access To Private Group Of Your Batch

Lifetime Access To PDF Notes

Access to Our Private Telegram Group

Live Q & A Sessions

Know Your Instructor

Deepak Sethia is an experienced trader with over 8 years in the stock market. As a trainer for the past 2 years, he’s empowered over 1000 individuals to become professional traders. Deepak’s vision is to instill in every trader the importance of trading based on calculated math and knowledge, rather than relying on tips or advice.

Join Deepak Sethia on a journey towards informed and empowered trading.

- Founder of Jama Dhan Stock Trading Institute

- Trading Experience of 8+ Years

- NISM Certified 🏅

- Trained Over 1000+ Professional Traders

Deepak Sethia ~ Founder of Jama Dhan

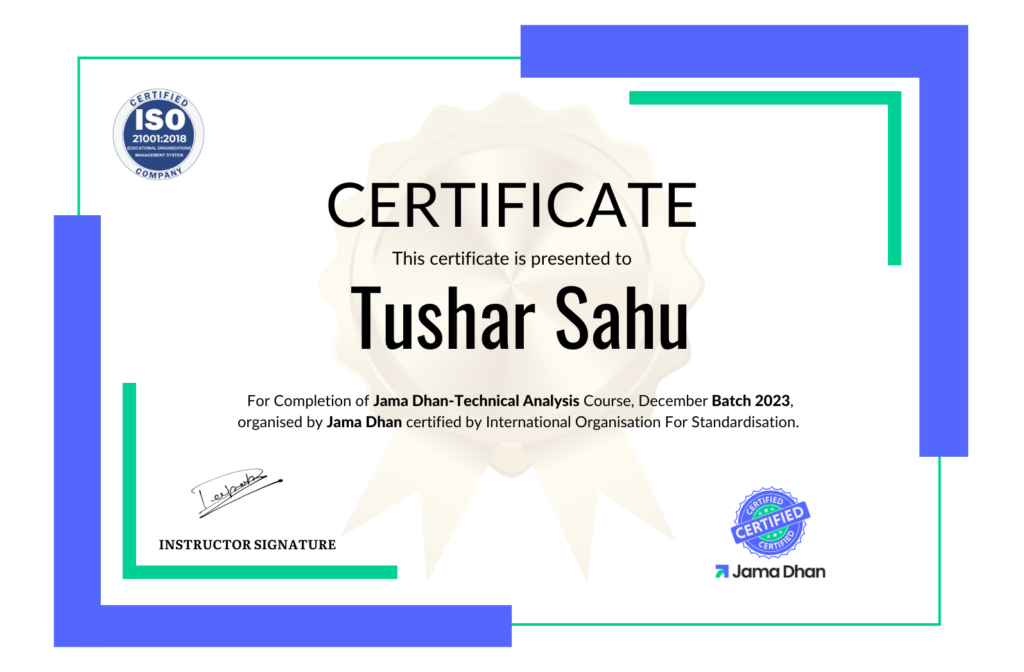

🌟 Certificate of Completion 🌟

This certification not only shows your competence in financial markets but also improves your credibility by providing a recognized and valued credential for professional growth in the financial sector.

Your Path to Trading Success: Course Highlights

During this course program, you’ll gain in-depth knowledge and skills, including

Secret of Chart Trading

Institution Trading Style

Risk Managment

Trade Managment

Secret Strategies

Don't Keep Your Potential Caged: Master the Stock Market

THERE’S A BULL INSIDE EVERYONE : Unleash it with Proper Training

Our comprehensive stock market courses are designed to unlock your trading potential and set your inner bull free. Here’s how we do it:

- Expert-Led Training: Learn from seasoned market professionals who share their insights, strategies, and real-world experiences.

- In-Depth Modules: Our courses cover everything from the basics of stock trading to advanced strategies, ensuring a thorough understanding of market dynamics.

- Practical Application: Gain hands-on experience through practical exercises and simulated trading environments, bridging the gap between theory and practice.

- Community Support: Join a community of like-minded learners and professionals, providing a supportive network to share ideas, strategies, and encouragement.

Early Bird Special! Limited Time Only! 🔥

Unlock exclusive savings by enrolling in our courses now! Don’t wait – this offer ends in just 7 days. Start your trading journey with Jama Dhan and benefit from our early bird discount.

700+ Students Already Enrolled...

Act Fast: Prices Will Increase by ₹5000 After This Sale!

💡 Claim Your Discount Today! 💡

I Choose Jamadhan Over Free Tips, Why?

Confidence in Decision Making

Gain the skills to analyze market trends and make informed trading decisions without relying on unreliable tips

Enhanced Risk Management

Learn advanced techniques to manage risks effectively, protecting your investments and maximizing your returns.

Consistent Trading Success

Develop a structured trading strategy that leads to consistent and sustainable success in the stock market

Success Stories of Jama Dhan Traders✨

Happy

Students

Hear from our students who have transformed their trading skills and achieved financial success with Jama Dhan Stock Market Institute.

Vineeta Agarwal

Trader

It was an amazing and informative experience with Deepak sir. Always available… And cleared all the concepts right from basics. The phenomena totally changed after enrolling with Jam Dhan. Definitely when I come to Jaipur, I will enroll for next level as well. Thank you so much for your guidance.

Uday Verma

Trader

The instructors at Jama Dhan stock market institute are top-notch! Their deep knowledge and practical insights into financial markets have been invaluable. They were always available to answer questions and provide guidance. The courses are perfectly balanced between theory and practice, making it ideal for both beginners and seasoned investors.

Gaurav Prajapat

Trader

Their teaching style is quite unique. They explain every topic in such a vivid and interesting manner that students have no difficulty in understanding. They always utilize real-life examples and stories, which make the concepts memorable.

Devanshu Gupta

Trader

A Awesome place for traders

What a atmosphere

What a staff

What a friendly teacher

Deepak sir what great personality

Anyone who want learning trading please visit one time for your best future

Thank you Deepak sir

Thank you jamadhan.

Shalendra Gupta

Trader

Jama Dhan is the best institute for beginners to learn about share market. It provides a friendly environment for studying. For the convenience of the students, limited seats are always kept in mind in every batch so that equal attention can be given to every student and their doubts can be resolved at the same time. The mentor here is Mr. Deepak Satia, who explains every topic in detail and resolves any doubt of the students at the same time. Until all students’ doubts are cleared, they do not proceed with that topic. While doing the course, one special habit of Deepak Sir which I liked the most was that whenever he starts the next day’s class, revision of the first day’s class is done so that the topic can be started by RELATE to the next class.

Gaurav Agarwal

Trader

A month ago, I joined jamadhan, and let me tell you, it’s the best institute for beginners to learn about the share market. The environment is super friendly, making studying very comfortable. They keep limited seats in each batch, so every student gets equal attention and their doubts are resolved on the spot.

Aakash Gupta

Trader

I’ve done basic course from here till now, It’s actually great learning for me, deep analysis of stocks, stock selection, perfect entry-exit. I’ve learned everything here. Deepak sir’s way of explaining topics is too good. Great learning and recommended place.

FAQ's

The Technical Analysis Course + Option Trading Course at Jamadhan is a comprehensive 30-day program designed to provide in-depth knowledge and practical skills in stock market trading.

No prior experience is required to join our Technical Analysis Course. The program is designed to accommodate beginners as well as experienced traders looking to enhance their skills.

Our course covers a wide range of topics including risk management, candlestick pattern analysis, chart reading, trend analysis, indicators, oscillators, and advanced trading strategies.

You will learn everything from the basics of options trading to advanced strategies, including risk management, volatility analysis, the Greeks, and multi-leg strategies. The course equips you with the knowledge to trade options like a pro.

Yes, upon successful completion of the Technical Analysis Course, you will receive a certificate from Jamadhan Stock Market Institute, validating your skills and knowledge in technical analysis.

Absolutely! We offer ongoing support through our exclusive student forum, regular webinars, and access to a network of like-minded traders. Additionally, you will receive updated learning materials and resources to keep your trading skills sharp.

Realated Courses

Combo Course (Technical Analysis + Option Trading)

This comprehensive online training bundle is designed for those who want to master the intricacies of the stock market. With the Technical Analysis Course, you’ll gain critical skills in chart reading and market indicators, while …Jama Dhan – Option Trading Course

Jama Dhan Option Trading Course offers a comprehensive and practical learning experience. Gain insights into various option strategies, manage risks effectively, and master the art of option trading. With expert guidance and cutting-edge resources, you’ll …Jama Dhan – Technical Analysis Course

Jama Dhan - Technical Analysis Course was created with the goal of releasing you from unaffordable losses, ignorance, and financial dependence. With Jama Dhan’s Pro Trader, a share market technical analysis course, you’ll gain the skills …